During midlife, wealthy families face distinct obstacles—changes in careers, elderly parents, college expenses, and evolving health concerns—all coming together to challenge even the most solid financial structures. For individuals earning well in their 40s and 50s, a “family asset firewall” serves not only as a means of safeguarding but also as a strategic plan that protects wealth, upholds their way of life, and ensures their legacies during this uncertain phase of life.

Career Crossroads: Safeguarding Earning Potential

Midcareer workers frequently encounter crucial turning points, such as burnout, changes in their industry, or career shifts by choice, which may put their income security at risk. Those who earn high salaries depend on their top earning years to accumulate wealth, so it’s essential to maintain a steady income. A strong protective barrier can involve defensive investments, such as stocks that pay dividends, rental properties with long leases, or annuities that offer consistent income, no matter what happens in their career. For business owners, creating trusts to keep personal and business assets apart helps protect family wealth from business fluctuations, providing a stable base during career changes.

Health Risks: Beyond Medical Bills

Health issues in midlife go beyond just seeing a doctor—they can affect how much you earn and access to your money. A major health condition might lead to retiring earlier than planned or taking breaks for expensive treatments, which can deplete funds saved for different objectives. Having good health insurance along with critical illness coverage offers protection: the insurance takes care of medical bills, and the critical illness policy gives you cash to help with living expenses, maintain investments, or pay for new types of treatment. Wise families combine health savings accounts with investment options, transforming preventive care into tax-friendly wealth growth that enhances their financial security over the years.

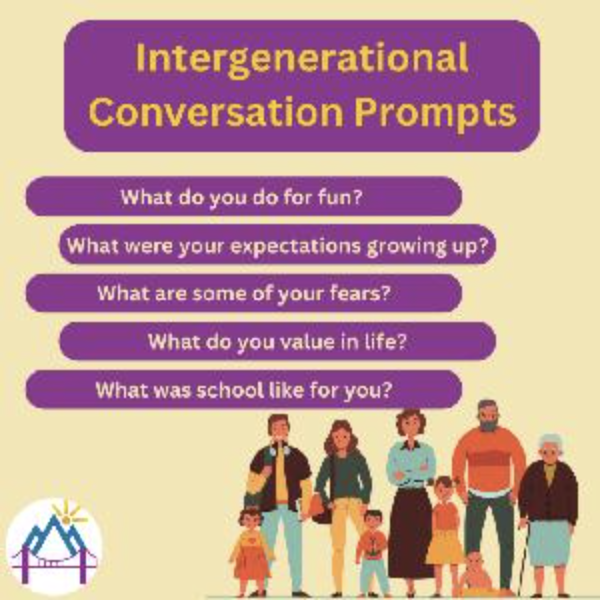

Intergenerational Responsibilities: Boundaries That Protect

The "sandwich generation" deals with two main challenges: taking care of elderly parents and paying for their children's education. These pressures can seriously threaten family finances without set limits. To protect assets, trusts can separate family wealth from costs related to caregiving, which helps keep retirement or inheritance funds safe. In addition, 529 plans that allow transferring funds between siblings help avoid putting too much financial strain on one child. Also, having long-term care insurance for parents decreases the chance of needing to sell investments in times of crisis. These strategies help manage responsibilities while keeping financial stability.

Market Volatility: Stabilizing the Core

During midlife, individuals often see their wealth reach its highest point, which makes them vulnerable during market declines. To protect against this, a robust strategy combines assets aimed at growth with those that are more stable, such as gold, private equity, or hedge funds that typically retain their value in economic downturns. Expanding investments across different regions and asset types helps lessen risks linked to local economic changes, while fixed-income securities with varied maturity dates maintain liquidity, preventing the need to sell during market lows. Homeowners can tap into equity lines of credit tied to their properties to provide quick cash at good rates, thus keeping their investment portfolios intact.

The difficulties faced during midlife call for more than just saving passively; there’s a need for strategic frameworks that safeguard wealth while promoting growth. For wealthy families, developing such a protective strategy turns potential risks into advantages, ensuring that the financial legacy built over years remains beneficial for future generations.