For wealthy investors creating complex portfolios, insurance is not just a backup plan—it serves as a key asset class that boosts diversification, enhances risk-adjusted returns, and offers distinct liquidity benefits. The most effective wealth creators see insurance as more than a standalone investment; they view it as an essential part of their overall asset allocation strategy. It collaborates with stocks, bonds, and real estate to build stronger financial structures.

Correlation Benefits Reduce Portfolio Volatility

The true benefit of including insurance in asset allocation comes from its weak connection to regular markets. When the economy struggles and stock prices fall, well-designed permanent life insurance policies can keep or raise their cash value, helping to balance your portfolio. This lack of correlation showed its importance during recent market fluctuations, as the insurance parts of portfolios gained 15-20% more than stocks during times of high volatility. Unlike standard assets that depend on market changes, insurance offers steady value that helps maintain stable portfolio performance throughout different economic periods.

Capital Efficiency Maximizes Resource Allocation

Wealthy individuals frequently fail to recognize the benefits insurance brings to the efficiency of their investments. When certain risks are handed over to insurance companies, it allows them to free up cash that would typically be kept as a backup fund. For instance, having a $5 million umbrella policy eliminates the need to keep the same amount in liquid assets to cover possible claims, freeing those funds for more profitable investments. This shift of funds—from safe reserves to growth-focused opportunities—enhances the overall productivity of the portfolio while still keeping risk levels stable.

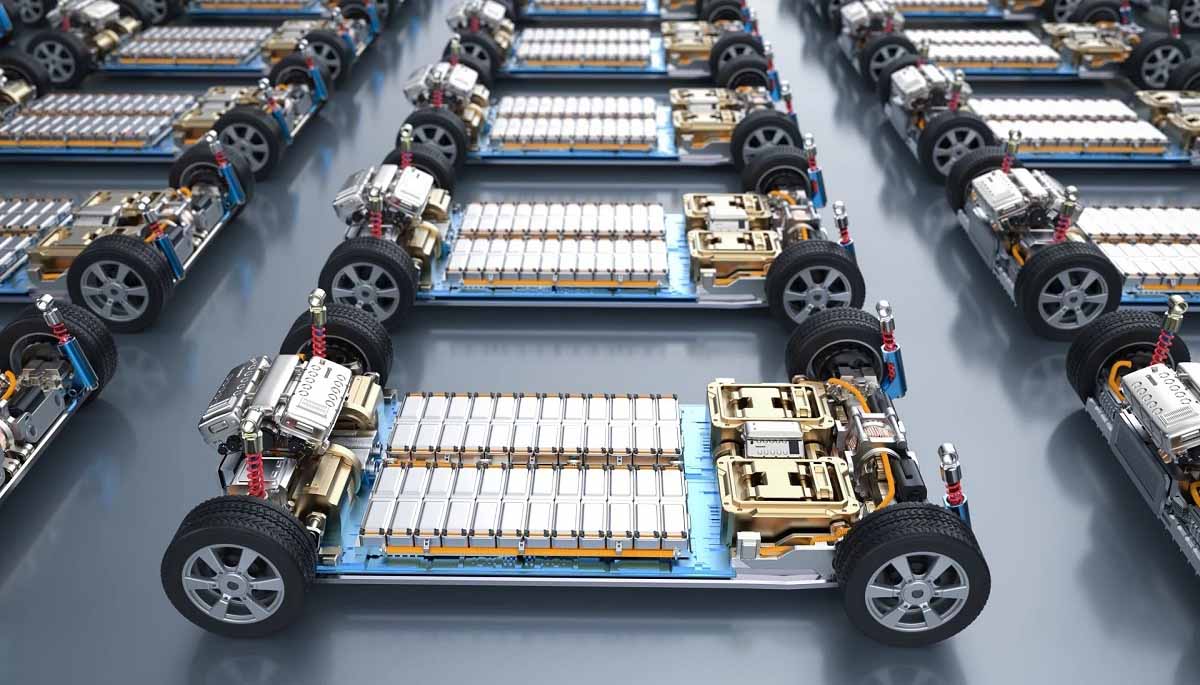

Illiquid Asset Balancing Creates Portfolio Harmony

Insurance helps address the issues posed by hard-to-sell assets, like real estate, private equity, and family-run businesses. The cash value of permanent life insurance can be accessed through policy loans, offering liquidity for urgent needs or timely investments. This approach prevents the need to sell assets in a hurry, which can negatively affect their long-term worth. Such a strategy allows for a flexible portfolio, even with unconventional investments included.

Tax-Advantaged Growth Enhances Net Returns

The advantages of insurance regarding taxes enhance how assets are distributed. Cash values in permanent policies increase without needing to pay taxes each year, which avoids the tax burden found in taxable accounts. For those in higher income tax brackets, this can provide an extra 2-3% in annual effective returns compared to taxable options. Well-structured policy loans allow for tax-free withdrawals, which can support overall asset distribution along with other accounts.

Legacy Positioning Strengthens Intergenerational Allocation

In order to transfer wealth across generations, insurance plays a key role in how legacies are allocated. Irrevocable Life Insurance Trusts allow for transfers of assets—like businesses, properties, and portfolios—to happen without taxes and probate, keeping these assets within family ownership. This careful arrangement helps to avoid the splitting of wealth during the estate settlement process.

When insurance is viewed as an important part of a financial strategy, it can strengthen a portfolio. Including insurance offers special benefits, such as steady returns, efficient use of capital, tax savings, and protection of one’s legacy, all of which create a strong foundation for preserving and growing wealth for future generations.