Do billionaires like Elon Musk buy insurance? Absolutely—but their approach transcends standard policies, reflecting a strategic vision that turns protection into a tool for preserving influence, innovation, and legacy. For the ultra-wealthy, insurance isn’t just about risk mitigation; it’s about architecting security that matches their complex lives.

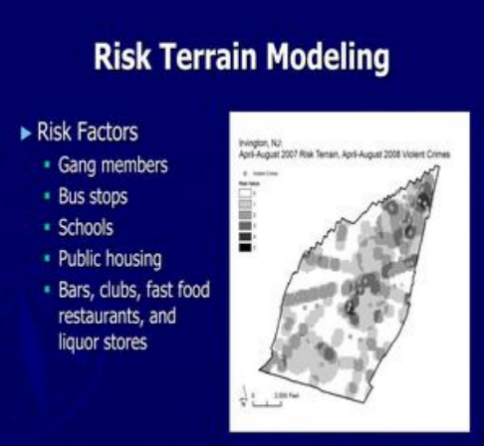

Mapping the Unique Risk Terrain

Wealthy individuals encounter risks that are as unique as their investments. For tech leaders who protect their innovative algorithms, manufacturers defending their global supply chains, or pioneers like Musk venturing into space, standard insurance policies don’t meet their needs. These individuals need tailored coverage for a range of issues, such as intellectual property disputes in AI or liability associated with space missions. Unlike typical insurance, these specialized plans begin with a detailed risk assessment, pinpointing weaknesses in digital properties, risks to reputation due to public exposure, and even international risks for businesses operating across borders. The aim is not only to provide insurance but to establish a protective barrier around the elements that contribute to their distinct wealth and influence.

Asset Isolation and Leverage Strategies

Affluent people utilize insurance to separate their personal belongings from business assets, which is essential in environments prone to lawsuits. By putting important assets into secure arrangements through carefully chosen policies, they protect these from business risks or legal actions. In addition to providing safety, insurance serves as a tool for gaining leverage: valuable life insurance policies that include cash value can often act as security for cheap loans. This enables individuals to access funds without selling off investments that could increase in value. This strategy transforms insurance into a powerful financial asset, ensuring liquidity while nurturing growth potential—which is vital for business owners looking to reinvest or expand their enterprises.

Adaptive Protection for Evolving Journeys

A fixed insurance portfolio does not meet the changing needs of wealthy individuals. Their coverage must adapt alongside their job advancements, purchases, and family developments. For instance, a tech entrepreneur may initially require cyber liability insurance, then later seek kidnap and ransom insurance as they grow internationally, and eventually focus on legacy-related policies as their family and charity aims develop. These strategies emphasize adaptability and mobility, catering to moves across countries, varying tax laws, and evolving regulations. For those with assets in different parts of the world, insurance plans that can easily alter their coverage and jurisdiction become essential.

Beyond Payouts: Strategic Value Creation

For those with substantial wealth, the real strength of insurance is found in its capacity to offer benefits that go further than just monetary payments. Advanced policies enhance tax efficiency by providing structured payouts that reduce estate and inheritance taxes. They also support family governance, utilizing insurance linked to trusts to ensure that generational wealth transfer rules are upheld and encourage responsible management. Additionally, charitable giving gains from this approach—donor-advised insurance plans enable thoughtful donations while offering tax benefits, merging financial protection with personal ethics. This shifts the role of insurance from merely a safety net to an active factor in establishing and maintaining a legacy, making certain that wealth addresses both current demands and future goals.