The athletic community feels a jolt whenever there are reports of unexpected deaths at marathons. For sports fans with high spending power, the dangers are more significant than most people realize. Having specialized insurance is not merely optional; it is essential for protection.

Beyond Basic Coverage: The Hidden Dangers

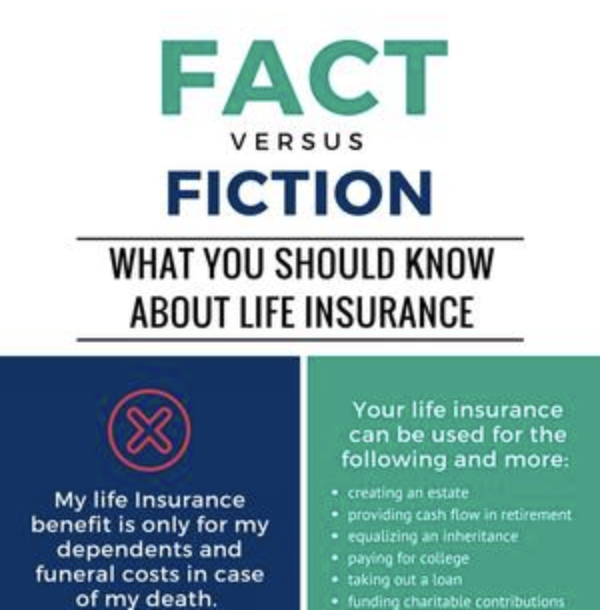

Standard health and life insurance plans often overlook coverage for extreme sports, such as marathons. Many typical policies categorize marathons as "high-risk activities," leading to exclusions for injuries or fatalities occurring during these events, or imposing strict limitations on claims. For instance, a common health insurance plan might pay for treatment of a sprained ankle after a race, but if the injury is classified as resulting from a "high-risk activity," the insurance may refuse to pay.Additionally, experiencing or witnessing a serious accident during a marathon can take a heavy psychological toll. While more comprehensive insurance plans may include mental health counseling, this is seldom part of basic policies. Addressing this need is essential for supporting athletes’ overall well-being in the long run, beyond just their physical injuries.

Specialized Insurance: Tailored Protection

For passionate marathon runners, having individual sports accident insurance can make a significant difference. These insurance plans are tailored to address various circumstances linked to marathons. They provide protection for sudden cardiac arrest, a common cause of fatalities in marathon events. Besides covering medical costs, certain plans offer substantial compensation in cases of permanent disability or death, providing financial support for the athlete and their loved ones.Another useful choice is event-specific insurance. This policy protects against unforeseen issues related to the marathon, such as cancellations due to severe weather or natural disasters. For athletes with considerable resources who dedicate a lot of time, money, and effort to prepare for particular marathons, event-specific insurance can help recover expenses for travel, lodging, and training equipment.

The Role of Wellness Riders

Luxury insurance plans often come with wellness riders that offer additional benefits. These incentives encourage athletes to stay healthy and to get regular health check-ups. For example, athletes who meet specific health criteria, like having a healthy heart rate and body mass index, might qualify for lower premiums or extra perks. This approach benefits personal health while also allowing insurance companies to better control risks.Additionally, wellness riders may provide access to advanced sports medical facilities and elite trainers. This extra support can greatly enhance the performance of high-income athletes and help lower the chances of injuries in marathons.

Holistic Risk Management

Insurance is only one aspect of managing risks. For high-net-worth athletes, taking a well-rounded approach is essential. This means undergoing thorough medical checks at advanced facilities before races, which can identify hidden health issues that might endanger them during marathons. Some insurance companies even collaborate with esteemed medical centers, giving their clients quick access to top-notch diagnostic services.Additionally, using personal safety gadgets like wearable technology that tracks vital signs in real time while racing can enhance insurance protection. These devices are capable of notifying medical personnel right away if anything seems off, which could be lifesaving.

The recent news of sudden deaths during marathons highlights the importance of awareness for affluent sports enthusiasts. By recognizing the limitations of typical insurance, looking into specialized coverage, and adopting a complete risk management plan, athletes can enjoy marathons with more confidence and better safeguards in place.