For individuals with substantial wealth, planning for insurance is a complex task that goes beyond just having basic coverage. However, having a large amount of money does not always protect against serious mistakes. These errors can be hidden within strategies that seem solid, jeopardizing financial stability even with large investments.

Overcomplicating the Portfolio

Affluent customers often get caught up in complicated insurance setups, attracted by claims of "all-in-one solutions." Combining several specialized policies—ranging from unique liability protection to multi-tiered investment options—leads to excess administrative tasks and higher expenses. The more policies someone adds, the greater the fees grow, complicating management and often resulting in overlapping coverage that wastes resources instead of providing better security. The façade of "personalization" hides inefficiency; the best strategies focus on integration rather than mere collection, making sure every product fills a unique, vital function within the overall financial landscape.

Sacrificing Flexibility for Prestige

High-end insurance products usually promote their exclusivity with strict terms that attract clients who care about status. However, rigid policies do not fit the changing lives of successful individuals—such as moving abroad, starting new businesses, or changing family situations. A policy that cannot adapt to changes in assets across borders or new tax laws becomes more of a risk than a protection. The best plans offer a mix of luxurious benefits and flexible design, enabling changes in coverage, beneficiaries, or payout options as life evolves.

Confusing Cost with Value

Rich people often think that paying higher premiums means they get better protection, missing the important difference between cost and value. High-priced insurance might offer extra features that raise costs without adding real benefits. On the other hand, some fail to recognize the importance of having the right coverage gaps, such as not having enough liability coverage for online assets or new risks in international business. The real value comes from how well a policy aligns with its purpose: the cost should reflect its ability to protect wealth, create opportunities, and secure legacies, rather than simply being about the price.

Disconnecting from Legacy Architecture

One of the most serious mistakes is to look at insurance as something separate from overall estate planning. Wealthy families frequently gather insurance policies without making them part of their plans for inheritance, which can lead to tax issues or complications during probate. These policies may not work well with trusts, leaving assets vulnerable to estate taxes or legal problems. On the other hand, some people depend too much on insurance for passing on wealth, neglecting their liquidity needs, which may force beneficiaries to sell assets quickly to pay taxes. The best strategies use insurance as a key link between managing wealth during one’s life and protecting legacy for future generations.

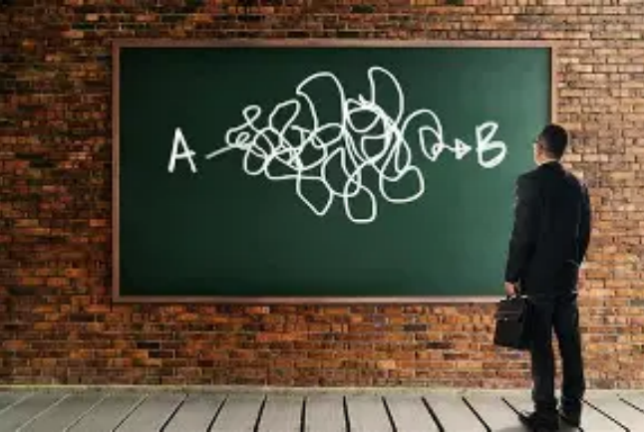

All these pitfalls have one thing in common: they treat insurance as an isolated product instead of an essential part of a complete financial plan. For wealthy individuals, steering clear of these problems calls for a clear understanding of goals, a careful assessment of the purpose of each policy, and ongoing adjustments to align with changing life objectives.