As our parents grow older, figuring out their financial needs goes beyond just meeting everyday costs. For wealthy families, it's crucial to protect inherited wealth while making sure they receive proper care. Common guidance typically highlights essential needs, but for those with more assets, thoughtful insurance strategies can change the way we think about elderly support.

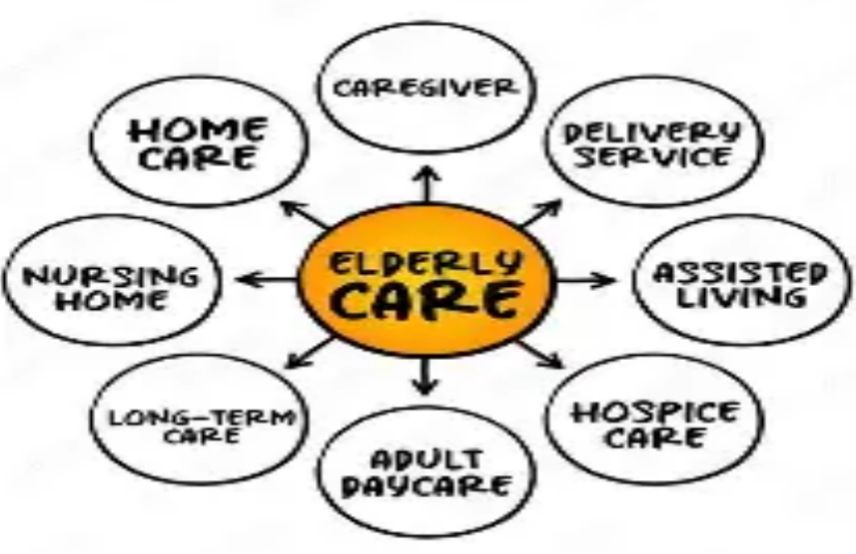

Beyond the Basics: True Costs of Elderly Care

The traditional perspective on the costs associated with caring for the elderly—such as housing, food, and medical expenses—only touches the surface of the issue. Families with higher incomes have even more factors to consider. Advanced medical treatments, including innovative therapies that aren’t included in public insurance plans, can become incredibly costly. For instance, treatments designed for rare diseases or advanced immunotherapy for cancer can lead to out-of-pocket expenses amounting to hundreds of thousands of dollars. Additionally, as parents grow older, there often arises a need for in-home care or upscale senior living facilities that offer tailored services. These high-end options can easily reach tens of thousands of dollars each year. Upscale senior living facilities typically provide amenities like personal chefs, on-site spas, and around-the-clock concierge medical services. While these come at a high cost, they significantly improve the quality of life for residents.

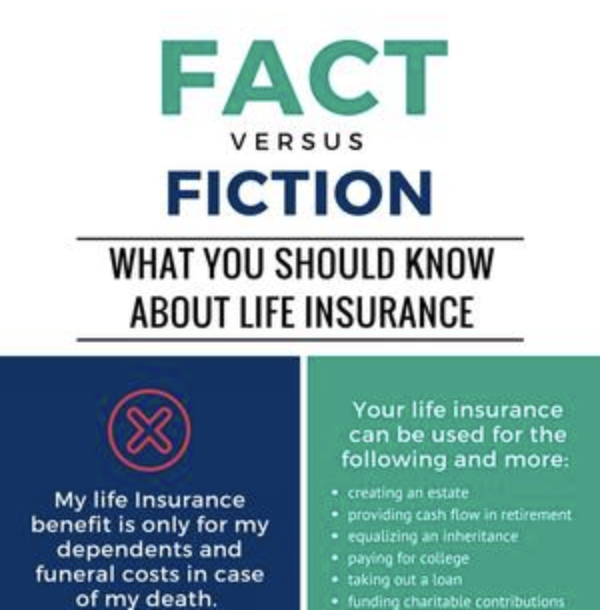

Insurance as a Wealth - Preservation Tool

Instead of draining their savings, high-net-worth individuals ought to think of pension insurance as a key asset. For instance, permanent life insurance plans not only provide death benefits but also allow cash value to accumulate. This means that policyholders can withdraw funds when they need to provide care while still preserving their financial legacy. The cash value in these plans grows without being taxed right away, and individuals can take out loans or make partial withdrawals to help pay for eldercare without facing immediate tax issues. Moreover, long-term care insurance can be tailored to include expenses for upscale facilities and specialized care, ensuring parents receive the best support without impacting family finances. Some of these policies even cover modifications to homes for aging in place, like wheelchair ramps or smart home safety features.

Tailored Insurance Selection

When selecting pension insurance, priorities should be flexibility and uniqueness. Search for plans that offer worldwide coverage, granting access to top-tier medical services. Certain insurers provide concierge options to manage complex healthcare requirements. This can involve securing second opinions from famous specialists globally, scheduling medical visits in leading hospitals, and even assisting with travel arrangements for treatments abroad. Explore hybrid options that merge long-term care advantages with life insurance or annuities. Such products are designed to adjust to evolving situations, whether your parents need immediate assistance or you wish to transfer wealth in a tax-efficient manner. For example, if your parents enjoy good health, the policy may still act as a valuable estate-planning resource, ensuring your family's wealth is preserved and passed on as you intend.

In summary, looking after elderly parents represents an investment in their health and your family's financial stability. By treating pension insurance as an advanced wealth management strategy, affluent individuals can effectively balance delivering exceptional care while protecting their financial resources.