Navigating the health insurance landscape in 2025 requires a strategic blend of personal needs analysis, financial planning, and detailed policy review. With evolving healthcare options and diverse plan structures, the goal is to find coverage that balances affordability, accessibility, and comprehensive care. Here’s a concise guide to help you make an informed decision.

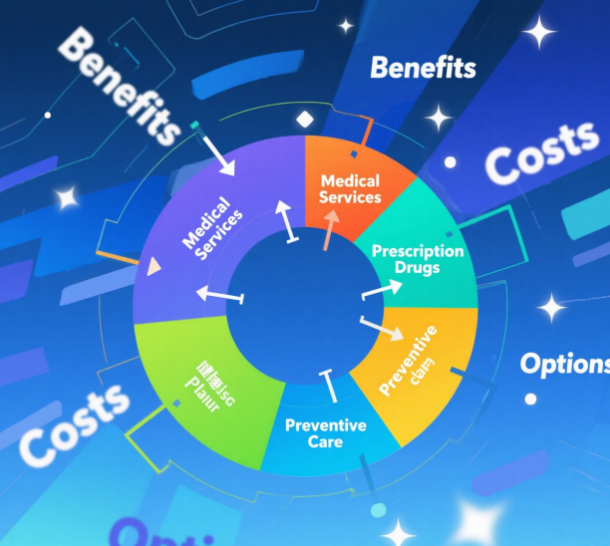

Start by assessing your unique healthcare needs. Young, healthy individuals might prioritize low monthly premiums and basic coverage for routine check-ups and emergencies, while those with chronic conditions, family planning goals, or regular specialist visits need plans with robust coverage for medications, treatments, and maternity services. Factor in lifestyle elements like mental health needs—such as teletherapy sessions or counseling—and preventive care benefits like free vaccinations or screenings. Creating a list of essential services ensures you focus on plans that align with your health priorities, avoiding undercoverage or unnecessary costs.

Next, balance monthly premiums with out-of-pocket expenses like deductibles, copays, and coinsurance. Low-premium plans often come with higher deductibles, suitable for those who rarely use medical services, while higher-premium plans with lower deductibles are ideal for frequent healthcare users. Calculate your potential annual spend by combining premiums with estimated costs for deductibles and copays; use online tools to compare total expenses across plans. Don’t overlook the out-of-pocket maximum, which caps your annual liabilities for covered services, providing financial security in unexpected situations.

Evaluate provider networks, policy details, and additional benefits to maximize value. Ensure your preferred doctors and hospitals are in-network to minimize fees, and check for telehealth options like unlimited virtual visits—critical for convenience. Understand key terms like deductibles, copays, and coinsurance, and review exclusions or preauthorization requirements to avoid surprises. Modern plans may offer perks such as mental health coverage, wellness programs, or tax-advantaged accounts like HSAs, which align with the needs of the 20–40 age group. Rural residents should confirm coverage for out-of-area care, while all users should research the insurer’s reputation for customer service and claim processing through consumer reports.

Choosing the right health insurance plan in 2025 is about harmony between your health needs, budget, and policy specifics. Prioritize plans that cover essential services, offer access to trusted providers, and include benefits that enhance your lifestyle. Use official marketplaces or reputable tools to compare options, and seek expert advice if unsure. The best plan isn’t the cheapest or most extensive; it’s the one that fits your life, providing peace of mind and reliable care when you need it most. By focusing on these key areas, you can secure coverage that protects both your well-being and financial stability.