Accomplishing medical opportunity through the acquisition of medical insurance is an essential way to deal with getting complete medical care. To explore this interaction effectively, it's essential to comprehend the different parts of medical insurance and how it can give you the vital opportunity and inner serenity. Medical insurance envelops a scope of plans, each custom-made to address various requirements. While it's not difficult to mistake it for federal retirement aide or government-upheld medical care frameworks, medical insurance offers extra advantages that take care of customized medical care prerequisites. Medical insurance goes about as a wellbeing net, giving inclusion to medical therapies, medical procedures, emergency clinic stays, drugs, and indicative tests.

With regards to accomplishing medical opportunity, it's pivotal to recognize fundamental medical insurance and particular plans like difficult disease insurance. Essential medical insurance, frequently alluded to as extensive medical insurance, covers a wide range of medical costs and offers monetary help during sickness or injury. This insurance type guarantees that you approach quality medical care without agonizing over exorbitant expenses.. Dissimilar to depending exclusively on government-subsidized medical care frameworks, medical insurance permits you to pick your medical care supplier, clinic, and therapy choices. This adaptability is especially critical for people looking for particular therapies or care from explicit medical experts.

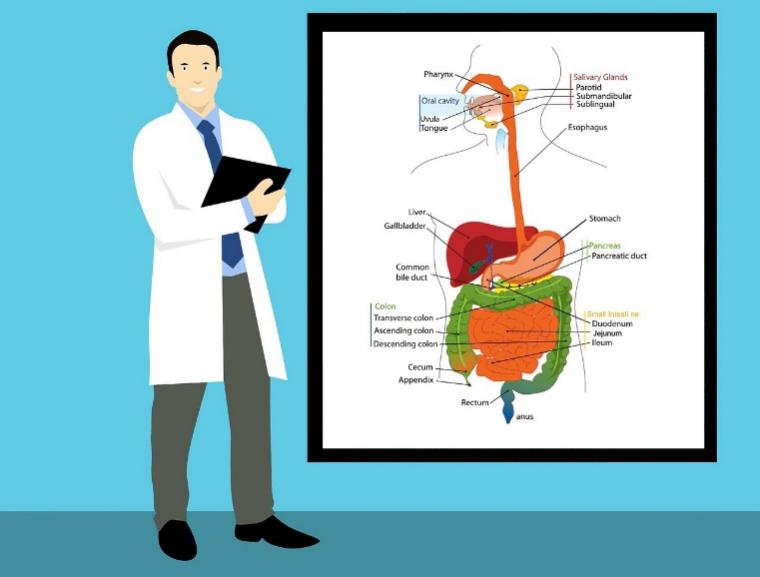

In the discourse gave, the idea of "list" is presented. This alludes to the rundown of medical administrations, therapies, medications, and methodology that are covered by the insurance strategy. Understanding the inventory is fundamental as it frames what medical costs will be repaid by the insurance supplier. Try to audit the inventory cautiously and guarantee that it lines up with your medical services needs and inclinations. One more huge benefit of medical insurance is the capacity to pick your degree of inclusion. Various plans offer shifting levels of inclusion, permitting you to fit your insurance strategy to your wellbeing status, family needs, and spending plan. Consider factors, for example, your age, existing medical issue, and the medical services needs of your relatives while choosing an inclusion level.

The differentiation between federal retirement aide records and spending accounts is essential to get a handle on. Federal retirement aide accounts are classified into pooling records and individual records. The pooling account conceals costs to a specific breaking point and normally follows a foreordained repayment proportion. Individual records, then again, can be utilized for costs that outperform the pooling account limit. Having lucidity on these records engages you to deal with your medical costs actually and settle on informed choices. Accomplishing medical opportunity through medical insurance includes cautious thought of the expenses and advantages. By buying medical insurance, you can relieve the monetary dangers related with unforeseen medical crises. It gives you the opportunity to get to a more extensive scope of medical administrations, pick your favored medical services suppliers, and have more prominent command over your therapy choices. Medical insurance awards you the opportunity to focus on your wellbeing and prosperity without settling for less because of monetary limitations. While choosing a medical insurance plan, it's prudent to evaluate your medical services needs completely, survey the inclusion choices accessible, and look for guidance from insurance experts if necessary. With the right medical insurance set up, you can unhesitatingly seek after a better and safer future, guaranteeing that your medical requirements are met without undermining your monetary steadiness.